Project Overview

This project uses a GARCH(1,1) model to forecast the future daily volatility of the Nasdaq Composite Index (^IXIC). The goal is to estimate how much price movement (volatility) to expect in the coming days, which is useful for risk management, trading strategies, and options analysis.

The project includes:

- Downloading daily Nasdaq data from Yahoo Finance

- Calculating log returns

- Fitting a GARCH(1,1) model

- Forecasting 30 days of volatility

- Comparing model forecasts with historical rolling volatility

- Wrapping the workflow into a reusable Python class

Key Outputs

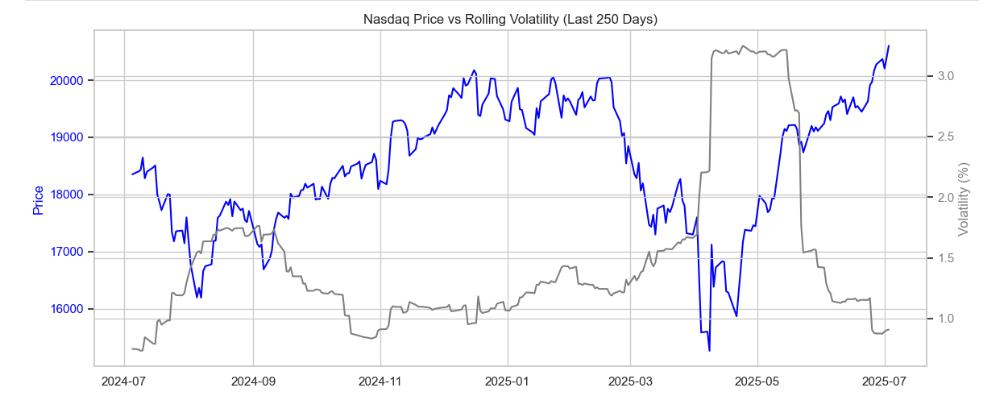

✅ Nasdaq Price vs. Rolling Volatility (Last 250 Days)

- Rolling 30-day volatility spikes during market drops.

- Calm price trends are usually matched by low volatility.

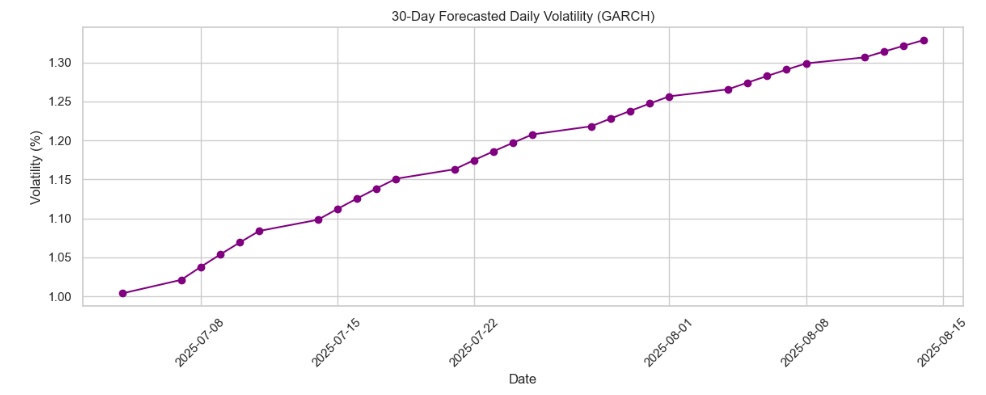

✅ 30-Day Forecasted Daily Volatility (GARCH)

The GARCH model captures persistence in volatility and forecasts a slight increase in the coming days:

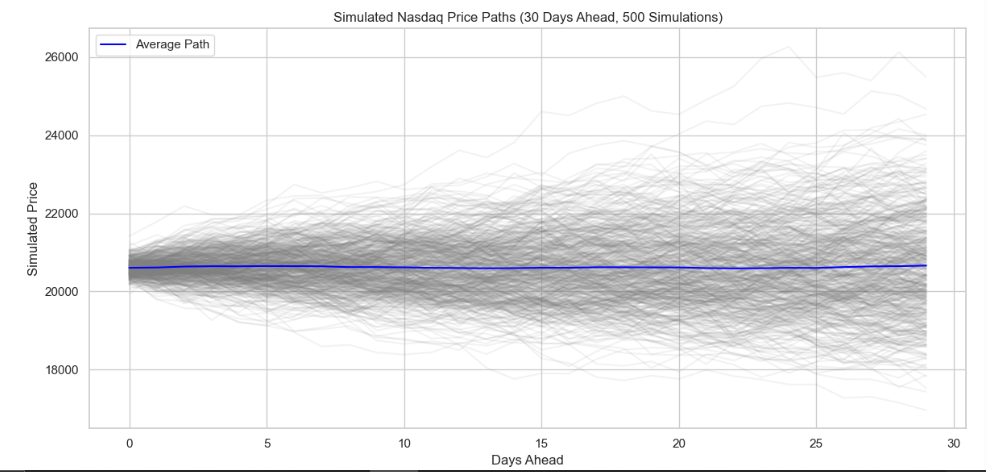

📊 Simulating Future Price Paths

Using the GARCH forecast, we simulated 500 possible future price paths to visualize the uncertainty over a 30-day horizon.

- Price paths are based on cumulative log returns with volatility scaling.

- The average path stays relatively flat (no return drift).

- The shaded region represents the 90% confidence band (5th to 95th percentile).

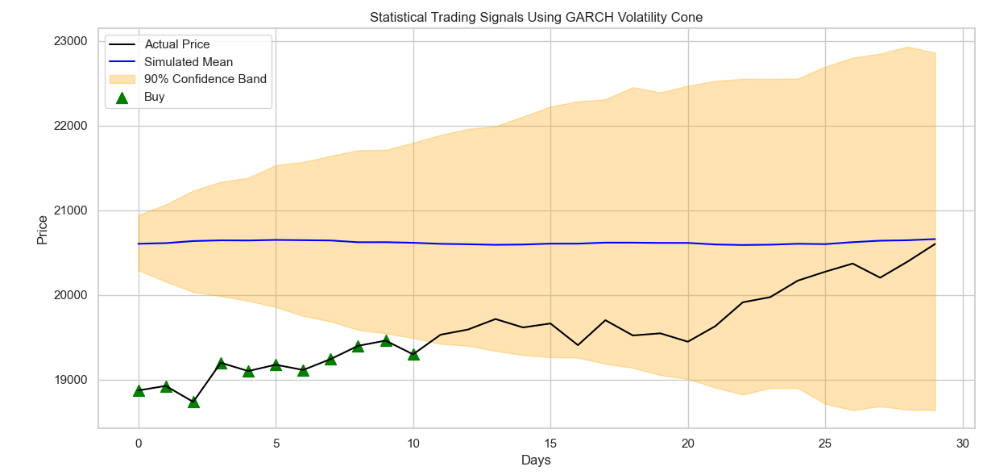

📈 Trade Signal Generation

We compared recent actual prices to the simulated volatility cone:

- Buy if actual price falls below the 5th percentile path.

- Sell if it exceeds the 95th percentile.

- Hold if it stays within.

This created a basic statistical trading rule based on extreme deviation from expected price movement.

Insights

- ✅ Most prices stayed inside the 90% cone - a sign that the GARCH forecast captured realistic risk.

- 📉 Only a few buy/sell signals were triggered - consistent with conservative statistical strategies.

- 🧠 Confidence intervals expand with time - showing how uncertainty grows in longer forecasts.

- 🔄 The approach is symmetric and agnostic to direction - it only reacts to large deviations, not trends.

How GARCH Helps in Trading

Volatility doesn’t predict direction, but it helps shape trading decisions:

- 📏 Position sizing: Reduce exposure in high-volatility environments

- 🧠 Risk management: Anticipate large moves during volatile periods

- 💸 Options trading: Use volatility expectations to choose strike prices or entry points

- ⚡ Breakout filters: Combine price and volatility to avoid whipsaws

Code Structure

The full workflow is encapsulated in a class:

model = GARCHForecaster("^IXIC")

model.download_data()

model.fit_model()

model.forecast_volatility(horizon=30)

model.plot_forecast()